Tech stocks may have sunk this year before getting some respite late last week on better-than-expected US inflation data, but it’s premature for investors to jump back in. When they re-enter the space, they should focus on profitable businesses rather than speculative “moonshots,” said in a note.

The US banking group said long-term prospects for technology stocks look positive but in the near term, the sector is not out of the wood, given concerns about higher borrowing costs and a possible global recession.

Late last week, markets rallied strongly following official US inflation data that came in below 8 per cent for the first time in eight months. The figures encouraged investors to think that the Federal Reserve might not tighten monetary policy further as aggressively as previously thought. The S&P 500 and the tech-heavy Nasdaq closed at 5.5 per cent and 7.4 per cent higher on Thursday, respectively. These were the largest daily rises in more than two-and-a-half years.

Such a move came after months in which technology stocks, such as prominent firms Amazon, Meta (aka Facebook) and Google have been hit hard. The stocks did well during the pandemic when home working and lockdowns prompted millions to download videos and order items online.

Citigroup reminded clients of how sharp the declines of 2022 have been. The five largest US tech giants have lost over $3 trillion in market cap since the start of the year. The S&P 100 IT sector has dropped 25 per cent year-to-date, while the Nasdaq is down 28 per cent.

Investors must wait for some improvement to come, Citigroup said.

“We acknowledge that valuations reflect new, higher capital costs and more conservative growth estimates, but immediate increases in profits and dividends are unlikely. After this 3Q reporting season, it is clear that tech won’t be spared from this particular downturn,” the bank continued.

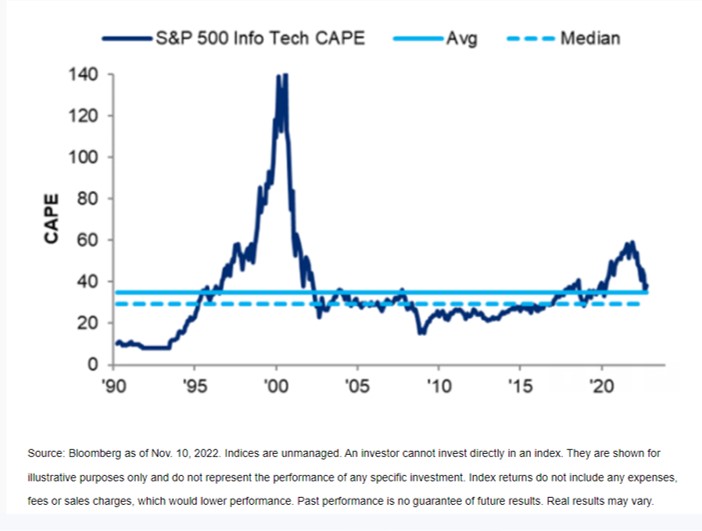

“We now see tech valuations that are much closer to longer-run averages. While we expect interest rates to fall later in 2023, a challenging earnings' backdrop is likely to initially offset some modest re-rating toward higher PE tech multiples in 2023,” it said.

“We continue to prefer quality names with less economic sensitivity, which in practice means a bias toward profitable tech over unprofitable moonshots,” Citigroup said.

The bank said that even if the Fed is less aggressive on interest rates, the central bank is far from making a “true policy pivot.”

“In the meantime, slowing economic growth is unlikely to spare these large platforms. Though fintech and e-commerce firms operate with a smaller physical footprint and less capital than banks and big-box retailers, they are likely to see slowing sales in the coming quarters as discretionary consumer spending fades. And for other tech segments, the likely deferment of capital expenditures by some firms will pressure bottom lines,” the bank said.

The bank pointed out that just a year ago, valuations for the US information technology sector were trading at their most expensive levels since the dot-com bubble. Multiples that were acceptable when interest rates were low have had to re-adjust to a sharply rising cost of capital and a rapid shift in preference among investors for near-term cash flows. Citi now sees tech valuations that are much closer to longer-run averages (see chart below). While the bank expects interest rates to fall later in 2023, a challenging earnings backdrop is likely to initially offset some modest re-rating toward higher PE tech multiples in 2023.

Tactically, the bank said it is reluctant to chase higher moves up in tech stocks until the economic picture clarifies.